Gross Profit is the profit a firm makes after deducting the costs of manufacturing and selling its products or providing its services. Gross profit will appear on the income statement of the company and can be computed by subtracting the cost of goods sold (COGS) from the revenue (sales). These data can be found on the income statement of the company. Gross profit is sometimes known as sales profit or gross revenue.

The formulas for gross profit and gross profit are as follows: net sales divided by cost of goods sold.

Formula for Gross Profit

Gross profit = Net sales − CoGS

where

Net sales

Equal to revenue, or money made from sales during the period. Since it can include discounts and deductions from returned merchandise, it can also be called net sales. Since it is on top of the income statement, revenue is usually referred to as the top line. To calculate net income, expenses must be deducted from revenue.

Cost of Goods Sold

Cost of goods sold: direct costs related to the production of goods, including labor costs and any materials used to make the product.

What is Gross Profit

Gross profit evaluates how effectively a business uses labor and inventory to produce goods or services. This metric mostly looks at variable costs, which are costs that change according to the level of output, such as:

- Materials

- direct labor, assuming hourly or output-based rates

- Commissions for sales employees

- Credit card fees required for consumer purchases

- Equipment, which may be impaired due to use

- production site benefits

- Shipping

Gross profit excludes fixed costs (i.e., costs that must be paid no matter the level of output), such as rent, advertising, insurance, salaries of employees not directly involved in production, and office supplies.

However, keep in mind that each production unit receives a portion of fixed costs under absorption cost, which is required for external reporting in accordance with generally accepted accounting principles (GAAP).

For example, if a company pays a building rent of $30,000 and a factory produces 10,000 widgets in a certain period of time, the absorption costing method will assign a cost of $3 per widget.

Gross profit cannot be confused with operating profit. Operating profit can be calculated by subtracting operating expenses from gross profit.

Gross Profit with Gross Profit Margin

To calculate another metric, gross profit margin, which can be used to compare a company’s production efficiency over time, only comparing gross profit from year to year or quarter to quarter can be misleading, due to worrying trends that can cause problems for the company, making gross profit increase while gross margin falls.

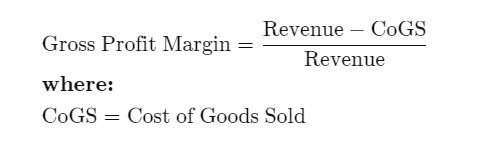

Gross profit and gross profit margin are different, both are shown as currency values, while gross profit margin is a percentage. Gross profit margin can be calculated with the following formula:

Gross Profit vs. Net Income

Gross Profit and Net Income are different indicators of a company’s financial ability to generate sales and profits. However, they serve very different purposes.

To calculate gross profit, the cost of goods sold must be deducted from net revenue, and then the remaining operating expenses of the business must be deducted. Net profit is the profit a business earns after all costs are accounted for. In contrast, gross profit only takes into account the cost of the specific product sold.

They serve completely different purposes for measuring business performance because these are two different calculations. Gross profit shows how well a company manages production, labor costs, raw material sources, and spoilage that occurs during the production process. Net profit shows whether a company’s operations make money when considering administrative costs, rent, insurance, and taxes.

How to Calculate Gross Profit

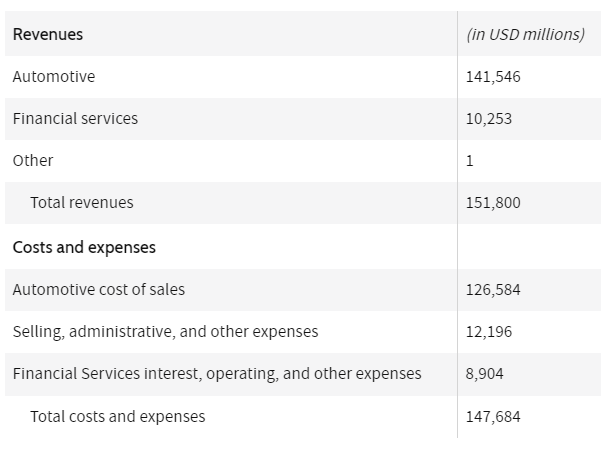

How to calculate gross profit and gross profit margin using ABC Company’s income statement is shown here.

To calculate gross profit, we first calculate the cost of goods sold (COGS), which amounts to $126,584, and we do not include selling, administrative, or other costs as these costs are mostly fixed costs. After that, we subtracted COGS from revenue to get gross profit of $25.216 million, which was calculated by subtracting $126,584 from $151,800.

We divided gross profit by total revenue to get a gross profit margin of $25,216 / $151,800 = 16.61%. This is higher than the auto industry’s average margin of around 14%, which suggests that Ford is working more efficiently than its competitors.

Advantages of Using Gross Profit

Businesses may prefer to conduct gross profit analysis rather than net profit analysis because gross profit differentiates the performance of the goods or services they sell. Businesses may consider implementing better cost control strategies by eliminating the “noise” of administrative or operational costs.

Compared to other elements in the business, gross profit is usually easier to control. Consider costs such as utilities (for office operations), rent, insurance, and inventory. Some costs are unavoidable during the course of business and can hardly be controlled.

In contrast, gross profit is determined by two components: net revenue (affected in part by the prices set by the company) and cost of goods sold (affected in part by the inputs paid by the company for its products). Therefore, management should limit their view to the things they can control.

Limitations of Using Gross Profit

Regular income statement reports generated by financial data services may show slightly different gross profits. These reports are accessible only to public companies and show gross profit as a separate line item.

Costs and expenses on a non-standardized balance sheet may be included in the gross profit calculation, so investors looking at private company earnings should take note of this.

Gross profit is useful at a high level however, businesses often need to delve deeper to better understand why they are doing poorly. For example, imagine a business discovers that its gross profit is twenty-five percent lower than its competitors. While gross profit can help spot problems, the company must now delve into all revenue streams and every component of cost of goods sold to truly know why it is performing poorly.

In addition, gross profit can be a misnomer, especially when looking at the profitability of companies in the service sector. Consider a law firm with no cost of goods. In this case, the law office’s gross profit equals profit. The company’s office rental costs, however, are twice as high as the monthly rent. While gross profit can show outstanding performance, it is necessary to pay attention to “below-the-line” costs when conducting gross profit analysis.

What does Gross Profit Measure?

Gross profit is a company’s revenue minus the cost of goods sold. Gross profit is usually used to measure how efficiently an organization manages labor and inventory during the production process. Typically, gross profit will take into account variable costs, which fluctuate compared to production output. These responsibilities can include labor, shipping, and materials.

Gross Profit Example?

Consider the following quarterly income statement, where a company earned revenue of $100,000 and cost of goods sold of $75,000. It is very important to remember that your cost calculation will not count selling, general, and administrative (SG&A) expenses. As such, the revenue of $100,000 will be reduced to $25,000 with a cost of goods sold of $75,000.